Start funding life on purpose.

Money isn’t complicated—our relationship with it is. That’s especially true for entrepreneurs balancing their professional and family finances. I can help you match your money with your purpose.

Money on purpose.

Build your business on purpose.

The first step of building a successful business is admitting you’re a business owner. So many entrepreneurs stumble into it accidentally, and it can be tough to say, “I run a business.” There’s a lot of risk and responsibility associated with that statement.

But when you aren’t running your business on purpose… you’re making an already tough job harder.

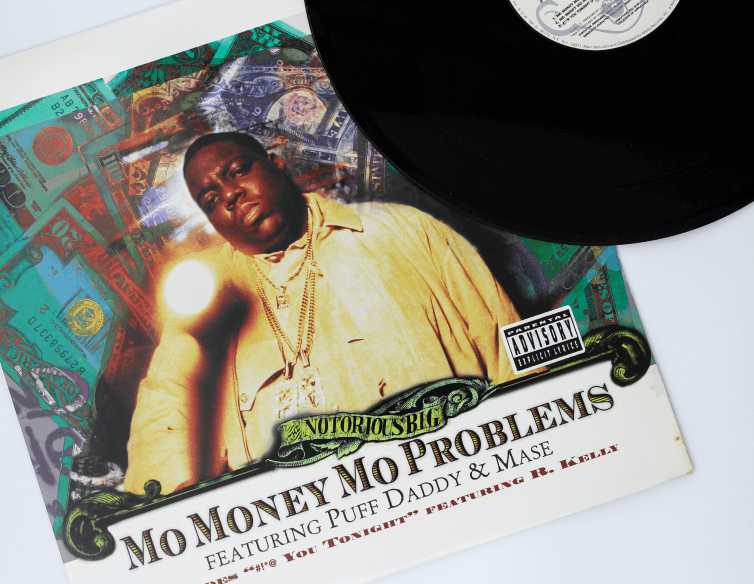

MORE MONEY,

MORE PROBLEMS PURPOSE

Success doesn’t mean you stop stressing about money. If anything, it can introduce more moving pieces to the mix.

- Am I getting the most out of it?

- Am I making mistakes?

- Should I be doing more?

Working with a financial advisor can help you answer those questions with data. But they can’t help you quiet that voice in your head. To do that, you need to align your finances with your purpose. Not sure how to do that?

Music on purpose.

PURPOSE IN A PLAYLIST

Why am I featuring my music on this website?

For me, living life on purpose (and with purpose) means music. My band helps me find fulfillment in a way financial planning can’t, and I embrace that.

Too often, I see people use their passions to chase profit… only to lose sight of their purpose. I’m here to address that. Remember: Your purpose isn’t tied to a paycheck.

We can build your passions into your financial plan, just like I did with mine.

Sincerely,

Morgan Ranstrom

CFA, CFP® & lead guitarist for Stone Arch Rivals

Life on purpose.

PEOPLE OVER PROFIT

Let’s consider a hypothetical. You’re in a situation where the most tax-efficient way to handle a financial issue doesn’t align with the goals you’ve outlined for your family. What would you want your advisor to do?

If you answered, “Get me my refund!” then I’m probably not the right financial advisor for you. (That said, my business partners and I absolutely love finding ways to reduce what you pay in taxes…)

Still, money is what you make of it. And I want to help you make it purposeful. I shared part of my purpose with you already. But I want to tell you a bit more about how I got here.